To identify the revenue or an expense in a period other than the period in which the transaction was posted, you can use functionality to automatically defer revenues and expenses over a specified schedule. Microsoft Dynamics 365 Business Central has an inbuilt capability to track deferral revenue and expenses. This helps in reducing the requirement to assess deferrals by hand and automatically spreading the expenses/revenues across multiple periods. This is mainly suitable if you have an annual fee for something that you don’t want to identify at the time you pay for the whole year. Dynamics 365 Business Central can spread the expense out over a specified time period by using the correct Deferral Code.

How to Add Deferral Revenue and Expenses in Business Central

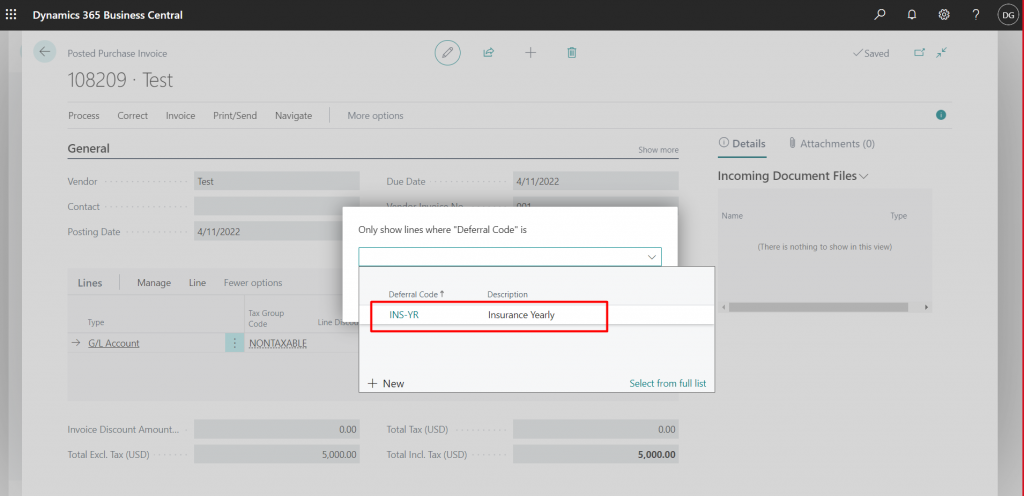

Firstly, select the account for the expense/revenue.

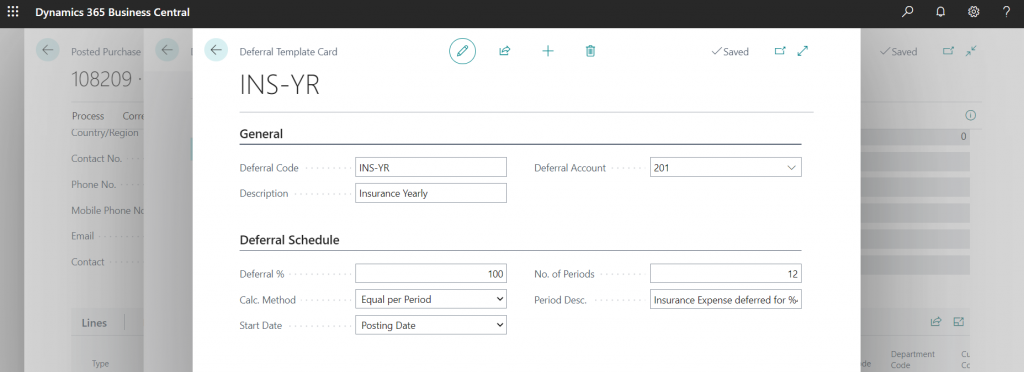

Secondly, setup or select the appropriate Deferral Code according to your deferral needs (equal per period, straight-line deferral, etc.) Here, you can also mention the number of periods you would like to defer the amount and when you would like the deferral to initiate.

Lastly, once you assign the deferral template code to the line, you can review the breakdown of the deferral through different periods to confirm the deferral is as needed.

Important Tip

If the deferral entries span past the current fiscal year, ensure the year(s) requiring have been create in Accounting Periods, otherwise, the entry will not save.

About MetaOption

MetaOption LLC is a Microsoft Gold Certified Partner and a leading solution provider of Microsoft Technologies and Consulting services run by a passionate, professional, and highly experienced team for Microsoft Dynamics Business Solutions. Our team consists of the experience of successful implementations, upgrades, and support with expertise across the industries. Our deep product knowledge helps us deliver the best solution to meet our customers’ business needs.

If you have any queries or concerns please contact us today at MetaOption.